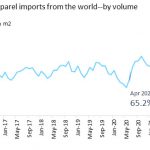

“Companies valuations offer potential upside as margins expand and we expect profitability of cotton yarn and man-made fibre (MMF) players to improve over the next few quarters on account of decline in input costs and moderate demand growth,” Crisil said.

During the H1 of this financial year, companies witnessed severe profitability pressures, which led to significant erosion in their market capita-lisation. The country, the world’s second-largest textile supplier, had this year set a target to increase its textile and garment exports to $33 bn.

The industry is sitting on a bank loan of over Rs 1 trillion and most companies have reportedly started defaulting on their payments to banks as a massive spike in raw material prices and a steep fall in demand have eaten into their margins.

Cotton yarn production is down 15 per cent and fabric output 19 per cent during the April-October period from a year earlier, shooting up prices. Out of the 226 listed companies, as many as 187 or 83 percent had poorer results in H1 of this fiscal compared to last year and 127 had net losses.