Global silk industry

Silk fabric was first developed in ancient China and later spread around the world via the ‘Silk Road’ and became popular among super-rich or high society. Nowadays silk is an affordable luxury for the middle class in Europe and the USA, and continues to hold its own in Asia as traditional ceremonial wear.

Even though silk has a small percentage of the global textile market – less than 0.2% (the precise global value is difficult to assess, since reliable data on finished silk products is lacking in most importing countries) – its production base is spread over 60 countries in the world. While the major producers are in Asia (90% of mulberry production and almost 100% of non-mulberry silk), sericulture industries have been lately established in Brazil, Bulgaria, Egypt and Madagascar as well.

Sericulture is labour-intensive. About 1 million workers are employed in the silk sector in China. Sericulture provides income for 700,000 households in India, and 20,000 weaving families in Thailand. China is the world’s single biggest producer and chief supplier of silk to the world markets. India is the world’s second largest producer. Ten per cent of world silk is produced altogether by Brazil, North Korea, Thailand, Uzbekistan and Vietnam. Sericulture can help keeping the rural population employed and to prevent migration to big cities and securing remunerative employment; it requires small investments while providing raw material for textile industries.

Supply and demand of raw silk

The five largest fresh cocoon producing countries are (in brackets average

production of last 4 years in tonnes of per year is reported): China (500,000),

India (126,000), Uzbekistan (20,200), Brazil (14,000) and Vietnam (13,000).

Countries with more than 300 tonnes of fresh cocoons per year are: Thailand, North and South Korea, Japan, Iran, Tajikistan, Pakistan and Indonesia.

Altogether approximately 35 to 40 counties are involved in sericulture. World production of raw silk is an average of 80,000 tonnes per year, about 70% of which is produced in China.

Italy is the world’s largest importer of waste silk which is spun into yarn for the production of knitwear. Japan is the country with the highest consumption of silk per capita. China exports the largest quantities of silk. USA imports the largest quantities of silk textile and clothes. Traditionally Asia was producing large quantities of silk and Europe was second.

In recent years, a great effort was made by FAO to develop Sericulture in Africa and Latin America. This was very successful especially in Brazil and Columbia. Today the production of raw silk in the European Union is very low, while the demand is very high; therefore, the European market requires imported raw materials from outside Europe.

China is the export world leader of textile products. European and American

suppliers have to face the challenge of competing against low-prices and large supplies representing a real challenge to their domestic industries. The textile industry is subject to the strongest constraints because it must meet retailing requirements and end consumers’ multiple aspirations.

The price of silk in global trade is increasing dramatically and in Italy converters are shifting to synthetic silk-similar products. A similar story can be found in the UK, following dramatic increases in the price of silk.

Silk industry in Europe

The European Union (EU) and the United States are the biggest consumers of silk outside silk-producing countries of Asia. Europe plays an important role as silk converters and consumers. France, Germany, Italy, Switzerland and the United Kingdom are consumers and also leading converters of silk. This is because they have excellent silk processing expertise and their silk products, scarves, ties, blouses, skirts, shirts and women’s dresses are all high-priced haute-couture exclusive pieces designed by top designers. European countries continue to dominate the fashion fabric and garment scene. Silk processing is rapidly shifting to silk producing countries in Asia and top fashion designers are also putting up their designing centres in Asia.

The major production area in France is the Lyon region whereas in Italy it is Como province. The UK production is traditionally in the North-west region of

England, although there is very little weaving and value-adding takes the form of dying, finishing and printing. There is also a value-adding industry associated with Asian communities in major UK cities (primarily again in the North West) and London.

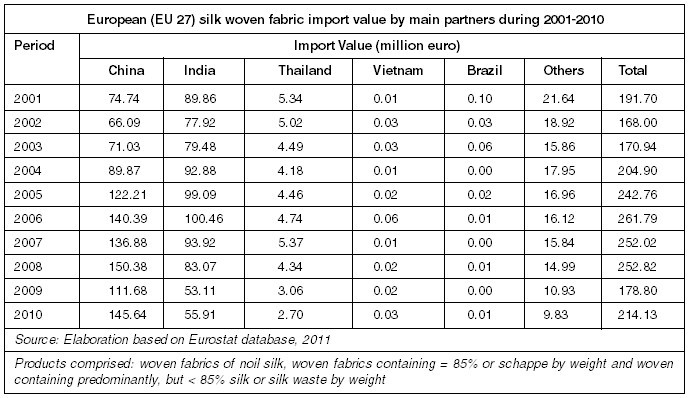

Imports of silk into EU

Statistical data from Eurostat shows that import value of silk fabric into EU from 2001-2010 is steady from approximately 191 million euro in 2001 to 214 million euro in 2010. The main suppliers outside Europe are China, India and Thailand. China remains the dominant supplier and the trend is to increase as its share of 62% of total silk fabric in Europe in 2009 grew to 68% in 2010.

Main final products of silk imported to Europe are women’s or girls’ blouses,

shirts and shirt-blouses of silk or silk waste; handkerchiefs of silk or silk waste of which no side exceeds 60 cm; ties, bow ties and cravats of silk or silk waste; and shawls, scarves, mufflers, mantillas, veils and similar articles of silk or silk waste.

Import value of final products of silk into EU from 2001-2010 are quite steady from approximately 249 million euro in 2001 to 285 million euro in 2010. The main suppliers outside Europe are China, India and Vietnam. China remains the dominant supplier and tends to consolidate its dominant position as its share grew from 54% of total silk final products in Europe in 2009 to 59% in 2010.

Main silk players in Europe

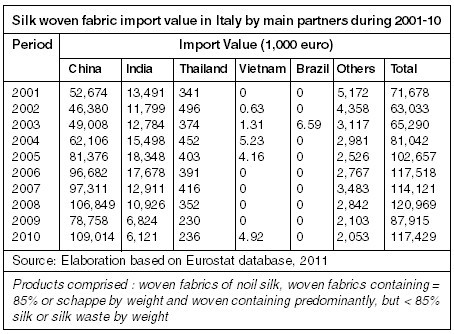

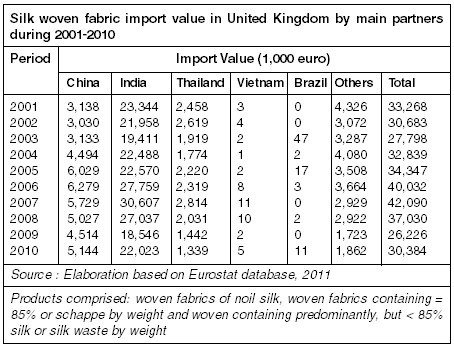

Italy is the largest importer of silk fabric, followed by the UK and France. In 2010 Italy imported silk fabric valued 117.4 million euro while the UK and France imported silk fabric valued 30 million euro and 19.4 million euro respectively.

Italy

Market size

Italy has been traditionally the largest importer, processor and exporter of silk

products in Europe. In 1997, Italy imported some 3,200 tonnes of raw silk and over 700 tonnes of silk yarn, primarily from China. Italy also imported about 300 tonnes of ladies’ blouses, of which over 80% came from China. Silk garment imports, however, have drastically gone down over the last five years. (In 1992, the country imported more than 700 tonnes of ladies’ blouses.)

In Italy imports of silk fabric has increased in value from 71.6 million euro in 2001 to 117.4 million euro in 2010, however, the values have fluctuated, depending on the year. China is the biggest supplier (93% of total imported value) followed by India (5%).

Products

Italy is well-known for highly developed skills in silk processing (finishing, dyeing and printing silk fabrics). Exports of silk scarves rose by about 15% between from 1996 to 1997, to 586 tonnes. Exports of silk neckties reached 1,230 tonnes in the same year.

United Kingdom

Market size

In the UK, the silk industry is an important part of the apparel and textile trade in the supply of raw and unfinished materials, fabrics and garments. The throwing, preparation and weaving of silk alone employs some 4,000 people and produces over £170 million worth of goods each year. The UK exports around £60 million worth of raw materials, yarns, fabrics, garments and accessories every year.

In the UK imports silk fabric in value are steady from 33.3 million euro in 2001 to 30.4 million euro in 2010, however, the values were fluctuating depending on the year. India is the main source of silk, followed by China and then to a lesser extent Thailand and some minor trade with Indonesia, Korea, France, and Italy. Raw silk from China is also often then exported to other eastern countries (India, Thailand) to weave into yarn that comes in to the UK.

Products

A wide range of yarn is principally used to supply the dressmaking, bridal wear,

specialist clothing and interior design markets. However, the UK silk industry is very varied and as well as producing the normal range of silk yarns, fabrics and garments other products include the manufacture of silk sutures for the medical profession, the knitting of silk gloves, which are used by jet fighter pilots in the Royal Air Force, and the hand weaving of silk fabrics.

Distribution Channel

Yarns are directly imported into the UK by organizations who re-sell (usually with little further processing or value-adding) to two distinct market channels.

Firstly, to small-scale specialty retailers (bridal wear, clothing, interior designers and decorators) and secondly to large flagship department store and chain-store retailers who specialize in clothing and fabrics for interior design.

Some of the large chains import some silk fabric directly; however, a handful of large importers (notably James Hare and Bennetts in the North of England and Pongees and Henry Bertrand in London) supply their needs. Some of these have a long-standing traditional family business interest. The ‘big four’ named above have a network of agents throughout the UK and a presence in European and increasingly global re-export markets for silk.

Economic recession in the UK may have slowed down the silk market a little; however, there is an element of the luxury and specialist nature of the product (for example, in bridal wear) that makes silk relatively resistant to more difficult economic times and new markets are opening up in growth economies outside of Europe.

The small-scale business customers are in fact still highly significant to all of the UK importers, rather than the large chain stores. In fact the UK importers prefer the business spread that dealing with small customers’ offers and this trade is not subject to the leverage of large retail buying chains.

Asian traders (for example, Indian migrants who settled in the UK) also import and supply often to the specific needs of the Asian community, and are based in London and other principal cities where there are significant Asian populations (the North-West and Midlands). The trade in UK specifically relating to Thai silk is relatively small and limited, with the most significant player who specializes in Thai Silk being Jim Thompson, who has a presence in London in conjunction with Fox-Linton Ltd.

France

Market size

France is another country with a considerable silk processing industry. For

centuries, Lyon has produced silk fabrics of the highest quality for domestic consumption and for export. France exports top quality silk fabrics to the US market, with unit prices reaching US$ 30 per m2.

In 2008, the French textile industry (including clothes) had about 804 companies (with at least 20 persons) employing 82,160 people. French companies have suffered along with the rest of the industry from the general economic slowdown as evidenced by the 3.3 percent decrease in jobs offered by these companies from 2007 to 2008.

Production has decreased by about 20 percent and total sales revenues as well as the rate of exportations have declined by 15 percent. According to market analysts, the textile industry will have to face again with the consequences of the economic recession for a few years.

In France, major textile suppliers are China (19%), Italy (13%), and Germany

(7%), followed by Turkey (6%), Belgium (5%), Bangladesh, India (4%), Tunisia,

Portugal, and Spain (3%) in 2007.

In France imports silk fabric in value are steady from 20.8 million euro in 2001 to 19.4 million euro in 2010, however, the values were fluctuating depending on the year. China is the main source of silk, followed by India and Thailand.

Products

More than 70% of silk fabrics in the French market have been traditionally used for clothing. There are signs that silk may have a growing market also for interior decoration use as curtains, wall covers, bed spreads and upholstery.

In France in 2008, the consumption of textile and apparel has declined as follows :

- Women’s wear: minus 3.8 percent

- Household textiles: minus 2.7 percent

- Men’s wear: minus 2.1 percent

- Children’s wear: minus 1.7 percent

- Baby’s wear: minus 0.2 percent

Global Silk Trend

International Trade Centre or ITC raised challenges for silk industry as follow :

- New competition – new synthetic fibers are ever-more sophisticated. They look and feel like silk, but are easier to care for. Viscose and polyester have taken some of silk’s market share.

- Changing image – while the boom for sandwashed silk is past, its introduction damaged silk’s luxury image. No international promotion campaigns are addressing this issue, reflecting the lack of cohesiveness among suppliers, traders and buyers in the industry.

- Regional slowdown – the fast-developing economies in Asia had been showing an increasing interest in silk products, as the standard of living rose steadily. Recent economic turmoil in Southeast Asia, however, has been reflected in a decline in sales.

- Dismantling production centres – silk production centres are closing. This trend is well underway in Japan and the Republic of Korea, due to the industrialization of the two countries. Millions of families in rural areas in China, Thailand, Brazil and other countries may now face the socioeconomic choice of whether or not to continue producing silk. If farmers turn from this activity for a more lucrative type of farming, the industry cannot easily recover. Working with silkworms requires strict discipline, learned by tradition through generations.

Furthermore, the increasing of raw silk price especially in China will have great

impact on prices of fabric, processed and final silk products. Thus, this may result in switching demand from silk to other substitute textiles.

ITC also suggested that generic silk promotion campaigns should contain the following elements.

- The image of silk : Silk should be marketed as an environmentally friendly, luxury product.

- New product categories : For instance, there is scope to expand the role of silk fabrics for interior decoration.

- The role of Asia : In the medium term, the role of the Asian markets will be vital. Asians will continue to be consumers, and it is likely that growth will resume in this area. It is important to safeguard their role as producers in light of the challenges facing them today.

Natural/organic textile standard : GOTS Standard and ThaiPeacock standard

Natural/organic textile standard : GOTS Standard and ThaiPeacock standard

Consumers who adopt a “green” lifestyle and therefore prefer environmentally friendly products have boosted the market of organic food, but recently also organic textiles (such as organic cotton) have been demanded by these consumers and a niche market has developed. However, despite organic standards and regulation have flourished in the food industry, most of the regulatory frameworks did not foresee an “organic” recognition to textiles.

Therefore, some producers and/or certification bodies have elaborated voluntary standards (e.g. GOTS standard) with the aim to provide a guarantee the consumers that a product has been organically produced in accordance with specific protocols and documented procedures. These opportunity attracted several producers and processors of cotton and wool that become fashion products in EU countries in recent years.

Basically silk is widely considered as a natural textile, since it is usually produced using few chemical fertilizers and practically no insecticides. The main issue that may cause concern in the environmental friendliness of silk is the dyeing processes. The use of natural environmentally friendly dyes (e.g., made from tree bark, vegetables and flowers) is the key point that allow the fabric to be considered organic. In addition, with organic silk, the mulberry trees they feed on are grown organically, without pesticides or fertilizers.

There are very few, if any, governmental bodies that regulate the labelling of silk as “certified organic”, since most of the organic labelling regulations are focused on food products. Also, although many companies trading in organic cotton (and other natural fibers) exist, almost no companies, do trade organic silk. Only one company (Alkena GmbH) was found that commercializes organic silk in Switzerland.

In this study, two standards have been considered that could be interesting to evaluate perception by EU stakeholders in the frame of future quality development of silk from Thailand: the Global Organic Textile Standard (GOTS) and the Thai Peacock Standard.

GOTS standard

The Global Organic Textile Standard (GOTS) is a voluntary standard which was developed by four Associations, namely : International Association Natural Textile Industry (IVN), Germany; Soil Association (SA), England; Organic Trade Association (OTA), USA; Japan Organic Cotton Association (JOCA), Japan. GOTS was introduced in 2006 and it is recognized as the leading processing standard for textiles made from organic fibers worldwide. It defines high level environmental criteria along the entire supply chain of organic textiles and requires compliance with social criteria as well. The aim of this standard is to define requirements to ensure organic status of textiles, including silk from harvesting of the raw materials, through environmentally and socially responsible manufacturing up to labelling in order to provide a credible assurance to the end consumer (as established in the EEC- Regulation 2092/91 on “Organic production of agricultural products and indications referring to agricultural products and foodstuffs”).

Only textile products that contain a minimum of 70% organic fibers can become certified according to GOTS. The standard covers the processing, manufacturing, packaging, labelling, trading and distribution of all textiles. The aim of the standard is to define world-wide recognized requirements that ensure organic status of textiles, from harvesting of the raw materials, through environmentally and socially responsible manufacturing up to labelling in order to provide a credible assurance to the end consumer. The final products may include, but are not limited to fibre products, yarns, fabrics, clothes and home textiles. Textile processors and manufacturers are enabled to export their organic fabrics and garments with one certification accepted in all major markets.

The certification process includes all the production value chain steps from fiber producers/farmers up to operators from post-harvest handling up to garment making and traders that must be certified according to a recognized international or national organic farming standard that is accepted in the country where the final product will be sold.

Currently, there is apparently no evidence of a relevant demand for organic silk. There may be a few niche markets, mainly referred to alternative retail and specialized ethnic shops. However, despite the “Green silk” concept is rather new to sericulture, silk is well placed to acquire green credentials since it is a traditional and basically low impact industry. This may be an advantage on the point of view of implementation of a green marketing strategy but, on the other side, the benefit perceived by consumers may be limited. In addition, consumers of silk garments in the developed world may not overlap with the segment of “green consumers”.

Thai Peacock Standard

Thai Peacock standard was established in 2004 by the Thailand’s Agriculture Ministry in order to identify genuine domestic silk production. Since traditional Thai silk is hand woven, each silk fabric is unique in the sense that it can’t be replicated exactly as the previous or the following ones. Yet, it has a unique luster, with a sheen that has two unique blends: one color for the warp and another for the weft. Color changes as you hold the Thai silk fabric at varying angles against light. The Ministry uses a peacock emblem to authenticate Thai silk and protect it from imitations. The peacock emblem serves as a guarantee of quality and it comes in four different colours based on specific silk types and production process (Gold, Silver, Blue and Green).

- Gold peacock. Indicates the premium Royal Thai Silk, a product of native Thai silkworm breeds and traditional hand-made production.

- Silver peacock. Indicates Classic Thai Silk, developed from specific silkworm breeds and hand-made production.

- Blue peacock. Indicates Thai Silk, a product of pure silk threads and with no specific production method (allows chemical dyes which is environmental friendly).

- Green peacock. Indicates Thai Silk Blend, a product of silk blended with other fabrics and with no specific production method.

There is hardly any evidence of awareness of this standard and the related logo among either consumers or silk industry operators. Some exceptions have been found in web pages reporting about winners of the international Peacock Standard Thai Silk Design Competition. The competition was co-sponsored by Thailand’s Queen Sirikit Institute of Sericulture and the International Textile & Apparel Association.

Since this standard is designed to identify the Thai silk production, it should serve as a quasi-brand that helps the consumer to identify, recognize, and possibly buy Thai silk products. It worth noting that this quasi-brand actually partially overlaps with labels indicating the country of origin of the product, which however is not subjected to any particular quality standard and quality control system. In this case, the value is built on a country’s supposed reputation. Generally, the country of origin gives a sort of a guarantee for the quality of the product.

Another relevant overlapping of this standard is represented by the potential use of a Geographical Indication (GI) as a marketing development tool, focused on the possibility to attach some value to the product because of its peculiar characteristics that are linked to the traditional know-how widespread in that area, to the knowledge deriving from a well-defined culture, as well as to a welldesigned TQM approach and the possibility to achieve a legal recognition in Europe.