A Review of Readymade Garments Sector of Babgladesh (July-September 2022)

|

Readymade Garments (RMG) industry is one of the mainstay of Bangladesh economy, experiencing a slowdown (8.14 percent) in the July-September quarter of FY23 as worldwide inflation has pushed up the living costs and forced people to reduce their expenditure on clothes in the key corresponding export destination countries.

However, the total export earnings of Bangladesh from the RMG sector in the said quarter were USD 10274.34 million, which outperformed that of the previous year’s corresponding quarter and the quarterly target by 13.41 percent and 2.52 percent respectively. Notwithstanding, the impetus of this sector may still be uneven as Russia’s invasion of Ukraine triggering the global gas crisis, upside inflation, tightening financial conditions and further US dollar appreciation worldwide.

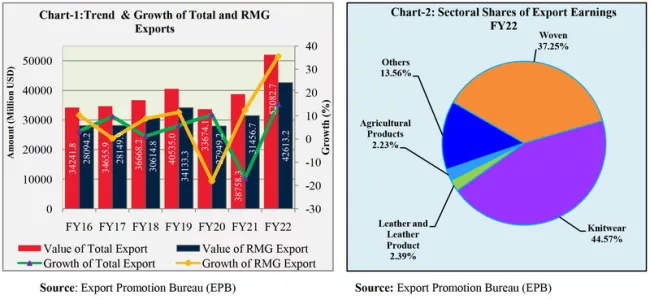

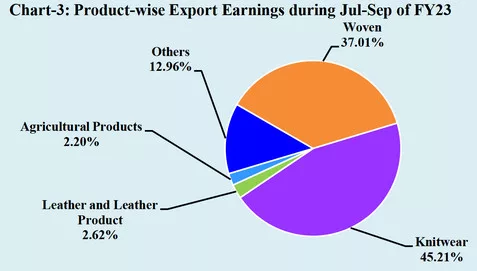

In FY22, the RMG sector contributed 9.25 percent to GDP. Bangladesh’s overall RMG export earnings stood at USD 42613.15 million, which was 35.47 percent higher than that of the previous fiscal year (Chart-1). The sectoral shares of export earnings in FY22 have been shown in Chart-2.

Quarterly Performance of RMG: July-September FY23

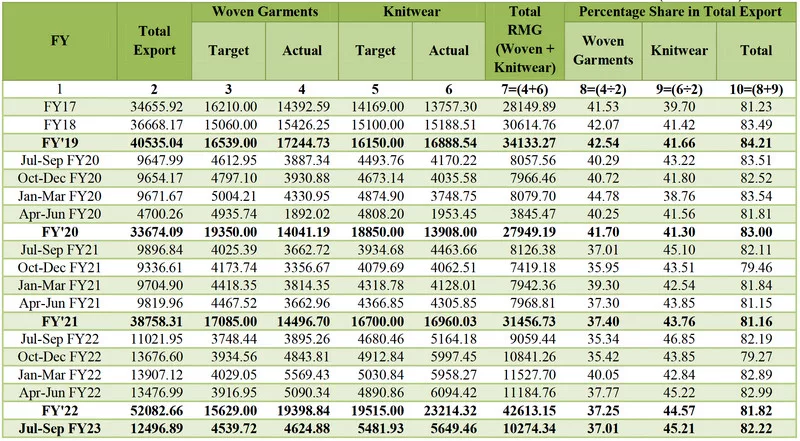

RMG’s export earnings stood at USD 10274.34 million during the first quarter of FY23. Despite downside growth in world-wide, RMG’s export earnings escalated into 2.52 percent higher than that of the quarterly target. Woven garments and knitwear contributed 37.01 percent and 45.21 percent respectively to total export earnings during the quarter under review (Table-1). Besides, in this quarter, the contributions of non-RMG products to total export earnings were as follows: leather and leather products (2.62 percent), agricultural products (2.20 percent) and other products (12.96 percent) (Chart 3).

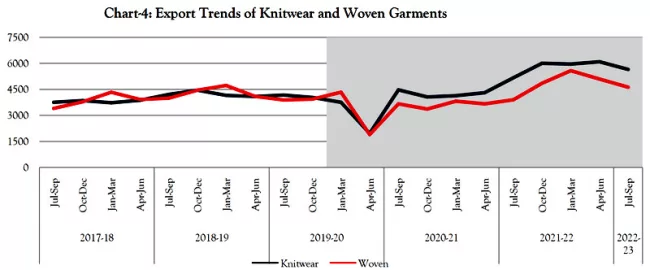

Knitwear

After experiencing a higher growth in the previous quarter, export earnings from knitwear squeezed in July-September FY23 to USD 5649.46 million, which was 7.30 percent lower than the previous quarter but 9.40 percent higher than the same period of the previous year. Furthermore, knitwear exports were 3.06 percent more than the target for the quarter under review (Table-1). Export trends of knitwear and woven garments are displayed in Chart-4 on quarterly basis.

Table-1: Export of Readymade Garments (From FY17 to FY22) (Million USD)

|

Woven Garments

The first quarter of FY23 showed a declining trend of export earnings from woven, which stood at USD 4624.88 million, 9.14 percent down from the previous quarter but 18.73 percent higher than that of the same quarter of the previous year. Moreover, exports of woven garments were 1.88 percent higher than the quarterly export target (Table-1). Chart-4 shows quarterly trend of export earnings from knitwear and woven garments.

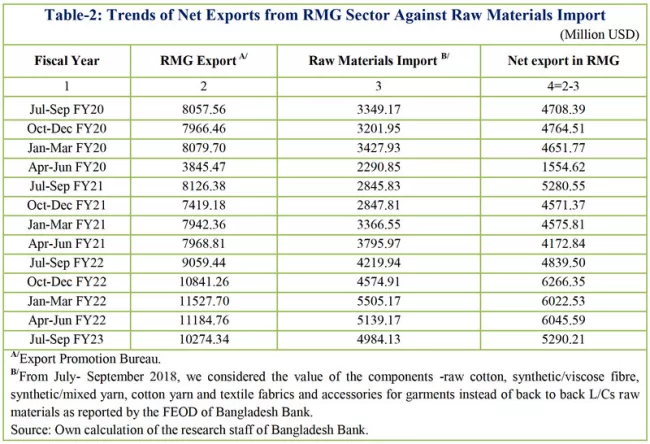

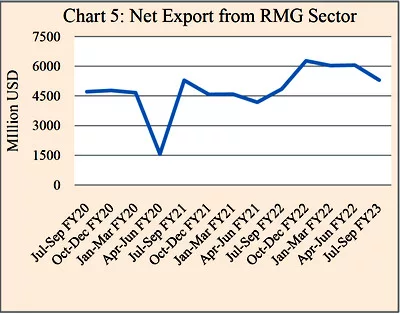

Import of Raw Materials and Net Exports from RMG

Import of Raw Materials and Net Exports from RMG

The import value of raw materials (raw cotton, synthetic/viscose fibre, synthetic/mixed yarn, cotton yarn and textile fabrics and accessories for garments) was USD 4984.13 million in July- September FY23, accounting for 48.51 percent of total RMG export earnings. As a result, net exports from this sector stood at USD 5290.21 million in the first quarter of FY23 which was 12.49 percent lower than that of the preceding quarter but 9.31 percent higher than the same period of previous year. The imports of raw materials and net export based on L/C statement from FY20 (July-September) to FY23 (July-September) are shown in chart-5 and table 2 respectively.

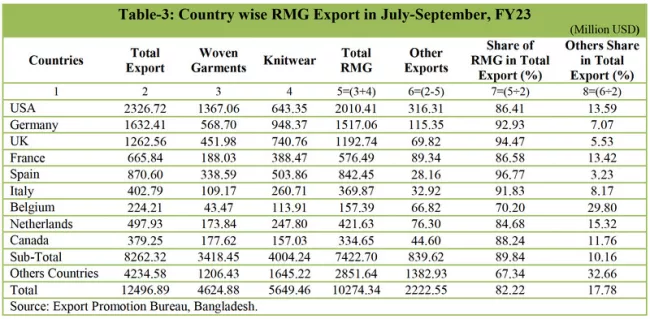

Destination of RMG Exports

The main destinations of Bangladesh’s RMG exports are the USA, Germany, UK, Spain, France, Netherlands, Italy, Canada, and Belgium (Chart-6). During July-September of FY23, total export earnings from these nine countries stood at USD 8262.32 million; of which 89.84 percent or USD 7422.70 million was earned from the RMG (woven 41.37 percent and knitwear 48.46 percent) exports (Table-3). During the quarter under report, RMG export earnings from these nine countries decreased by 9.65 percent as compared to that of the previous quarter but this was 12.18 percent higher than that of the corresponding quarter of the preceding fiscal year.

Recent Measures Taken to Facilitate RMG Exports

The government and the Bangladesh Bank have undertaken a number of measures especially for facilitating production and export of the RMG sector. Some important measures taken to boost up production and export of the RMG sector are highlighted below:

Pre-shipment Credit: To continue the export activities of export oriented RMG industries amid the Corona pandemic, Bangladesh Bank has formed a refinance fund worth of BDT 50.00 billion. RMG entrepreneurs can take loans from this fund through banks at 6 percent rate of interest (BRPD Circular No 9, Date 13 April, 2020). Recently, for the betterment of economic growth in export sector, BB reduced the interest rate on this refinance fund from 6 percent to 5 percent at receiver level and 3 percent to 2 percent at bank level (BRPD Circular No-26, Date 26 April, 2021). Bangladesh Bank has expanded the tenure of loan facilities for entrepreneurs from 01 year to 03 years under this refinance scheme. Entrepreneurs can avail the loan more than one time within the mentioned period (BRPD circular no: 44, Date 30 September 2021).

Incentives for Export Expansion: During the FY23, to encourage the country’s export trade, export subsidies or cash incentives have been given for some export items from 1 July 2022 to 30 June 2023. Among them, 4 percent cash incentive has been given to export oriented garments sector, small & medium industry of garments sector and to help expanding the new items/ new market garments sector (excluding the USA, Canada, EU, UK). Inspite of existing 4 percent cash incentive, additional 2 percent has been given as support for the exporters of garments sector of EURO zones. Morever, 1 percent special cash incentive has been given to RMG sector (FE Circular No-26, Date September 19, 2022).

Extended Facilities for Trade Transactions: To facilitate smooth transition in the external trade activities of the country, the following decisions have been implemented:

- The usage period for industrial raw material imports, including back-to-back imports under supplier or buyer credit, has been extended up to 270 days under the Guideline for Foreign Exchange Transactions (GFET)-2018, Vol.-1. Later, it has been decided to extend the usance period to 360 days from 270 days effective till December 31, 2022. The extended usance period will not be applicable for imports under EDF loans (FE Circular No-18, Date July 20, 2022).

- The Export Development Fund (EDF) limit for individual BTMA and BGMEA member mills have been enhanced to USD 30 million from USD 25 million and the period of EDF loan remained valid for the respective transactions till December 31, 2022 (FE Circular No-16, Date July 19, 2022).

Conclusion

As the present economic turbulent situation prevailed more in our major export destination countries, Bangladesh should set its new target destination towards promising Asian economies like Japan, India, China, South Korea and the Middle East. At the same time, Bangladesh should also put priority on diversification of man-made fibres (MMF) and global technical textile markets as they fetch higher profits than cotton-made items.

(Courtesy: Research Department, External Economics Wing, Bangladesh Bank)

Also Read : Bangladesh Readymade Garments (RMG) Industry: April-June 2022 Review