The Netherlands has set an ambitious goal: full circularity by 2050 and halved resource consumption by 2030. Meeting this goal will require change spanning sectors—and the textile and clothing industry, which releases 1.2 billion tonnes of CO2 each year—must be prioritised.

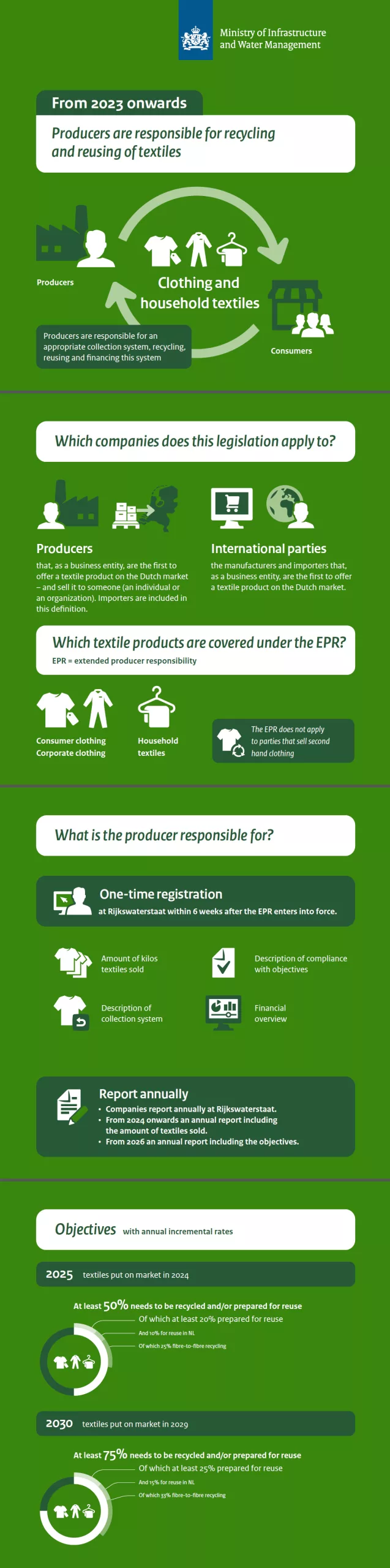

Extended producer responsibility for textiles from 1 July

The Netherland’s Ministry of Infrastructure and Water Management has implemented extended producer responsibility (EPR) [Uitgebreide Producenten Verantwoordelijkheid (UPV)] for textiles in the Netherlands. From the 1st of July 2023 onwards, producers are responsible for recycling and reusing of textiles. This means that producers are responsible for an appropriate collection system, recycling and reusing of clothing and household textiles and the financing of this entire system.

Currently, municipalities are still responsible for collecting the discarded textiles of their inhabitants. With the introduction of the EPR, producers will be responsible for this. They pay the costs for waste management. Fashion chains themselves will be responsible for the collection and recycling of discarded clothing.

The UPV will apply to all parties that put clothing on the Dutch market. In addition to consumer clothing, the UPV also applies to work clothing.

|

The Dutch clothing- and textile sector

Estimated is that the Dutch clothing market on its own comprises a magnitude between the 700 and 900 million pieces of clothing each year. This excludes shoes, household and bed textiles, pillows, sleeping bags, duvets, bags, flags, awning and many other forms of products (partly) composed of textile.

On top of that, there are 14,000 estimated registered companies that manufacture textile, clothing or shoes or trade such products as agents or wholesales. These companies employ an approximate amount of 68,000 employees. In addition, there are 80,000 people that work in the clothing, (interior) textile, sports and shoe shops in roughly 20,000 branches. Herein, the extensive number of 10,000 webshops that do not possess physical shops is not included. Moreover, thousands of people provide services for the sector. One can think about designers, models, people connected to events and PR, IT services, logistical service providers and many others.

For centuries the clothing and textile sector thrived in the Netherlands during which Leiden, Twente and Brabant were the most important regional centres. However, today the number of manufactures of clothing in the Netherlands is very low. Nevertheless, there are companies that own production facilities abroad. For the very specialised companies in the textile- and carpet industry this is different. These high-end, capital intensive companies manufacture (partly) in the Netherlands. Clothing is also manufactured in the Netherlands but on a very small scale: only monsters and samples. As soon as production is scaled up, companies seek to produce in countries abroad. Not only Dutch companies operate this way, other companies in the European Union (EU) operate similarly. According to statistics of CBS (Statistics Netherlands) primarily countries in Asia like China and Bangladesh, Turkey and countries in Northern-Africa manufacture clothing and textile for companies from the EU.

A big part of clothing that is imported by Dutch companies is mainly exported within the EU. As such, the Netherlands import 13 billion euros of clothing of which 10 billion euros is exported. The remaining 3 billion euros (import value) is brought into the Dutch market by wholesales and many other retail channels.