- Clothing activity recovered in Q4 2022, while performances in the textile industry weakened.

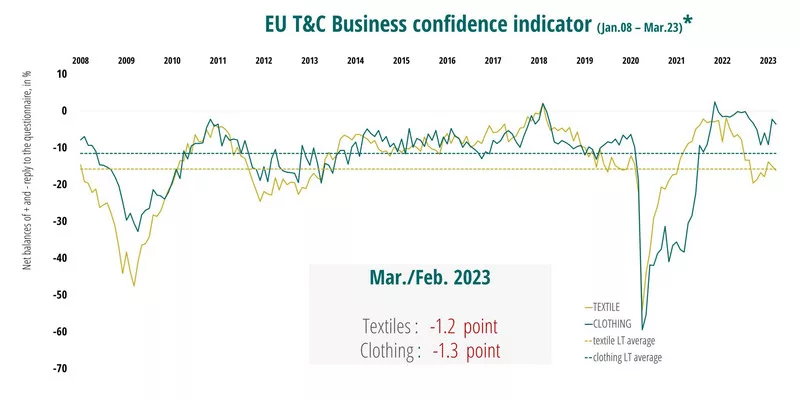

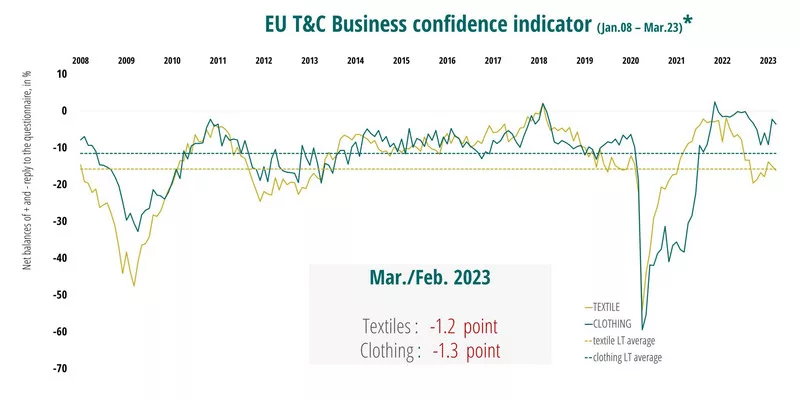

- In March 2023, confidence worsened in the entire value chain, suggesting that economic activity in the T&C sector will contract in Q1 2023.

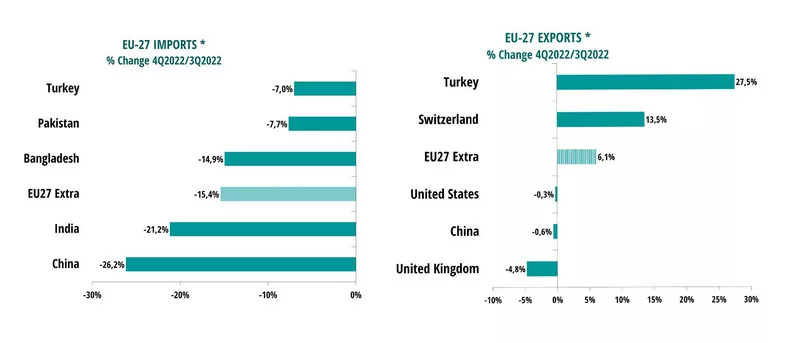

Economic performances in the textile & clothing industry showed a mixed picture in the 4th quarter of 2022, as companies in the upstream sectors are still struggling with tough market conditions and insufficient demand. On a quarter-to-quarter basis, textile’s turnover and production deteriorated, while the clothing segment showed a strong rebound in activity. The labour market evolution turned negative and worsened in the entire T&C value chain. Finally, EU export performances ended the year with a significant increase in value, while imports were reduced, leading to an improvement in the EU trade balance.

Since Autumn, the EU economy has seen a number of positive developments. The European gas benchmark price has fallen below its pre-war level. Despite the energy shock and ensuing record-high inflation, the EU economy managed a broad stagnation in the fourth quarter, instead of the expected contraction. Three months of falling inflation rates confirm that the peak is now behind. However, 2023 began with a new downside risk to the global economy: turbulence in the banking sector, which will increase economic uncertainty.

Since Autumn, the EU economy has seen a number of positive developments. The European gas benchmark price has fallen below its pre-war level. Despite the energy shock and ensuing record-high inflation, the EU economy managed a broad stagnation in the fourth quarter, instead of the expected contraction. Three months of falling inflation rates confirm that the peak is now behind. However, 2023 began with a new downside risk to the global economy: turbulence in the banking sector, which will increase economic uncertainty.

Economic sentiment in the T&C industry has deteriorated, suggesting that economic activity will contract in the first quarter of 2023. The EU Business Confidence indicator for the months ahead weakened in the textile industry, resulting mainly from managers’ more pessimistic views on their production expectations and adequacy of stocks of finished products. Similarly, business sentiment saw a slight deterioration in the clothing sector, due to negative developments in managers’ appraisals of the order-book levels and in their assessments of the adequacy of stocks of finished products.