Introduction

There are two types of colorants – dyes and pigments. Dyes are soluble substances used to pass color to the substrate and find applications primarily in textiles and leather. There are several types of dyes, however in India disperse, reactive and direct dyes are most commonly used. Pigments are insoluble substances and could either be in powdered or granular form. They impart colour by reflecting only certain light rays. Their major end use industries are paints and inks. Pigments can be broadly classified as organic and inorganic.

Global industry

The global colorant industry is valued at US$ 27 Bn and has been growing at 2-3% p.a. The dyestuff industry has seen turbulent times in the past decade. The decline of the traditional producers in the developed world, particularly in Europe, and the simultaneous ascent of new ones in Asia, particularly India and China, is arguably one of the most significant changes ever seen in this industry. The shift has been quite swift and followed the migration of end-user industries – notably textiles and leather – to low cost economies of Asia.

Indian industry : Overview and outlook

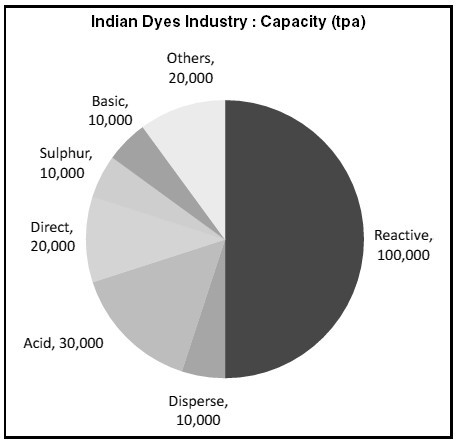

India accounts for 12% of the global colorant industry, out of which nearly 2/3rd is exported. In 2010, India produced ~200,000 tonnes of dyes. Of this, 50% were reactive dyes due to the availability of important raw materials like vinyl sulphone, etc. Nearly 70% of the dyestuff was supplied to the textile industry while leather and paper industries accounted for the remaining.

The sector is dominated by unorganized players and has ~1000 players in the small scale category. There are only 50 large organized units. These units are mainly present in Gujarat and Maharashtra, with the former accounting for almost 80% of capacity.

Per capita consumption of dyestuff is ~50 gms compared to the world average of 300 gms demonstrating a largely untapped domestic market. India has largely been an exporting country and has emerged as a global supplier of reactive, acid, vat and direct dyes accounting for ~10% of world trade. Also, these dyestuffs are exported to Europe, South East Asia and Taiwan to cater to the textile industries in these countries. However, almost 80% of these are commodities and face intense pricing pressures reducing the margins of the industry.

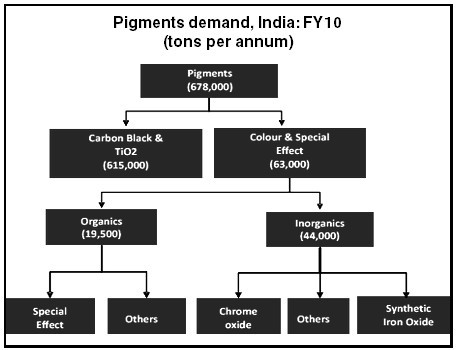

The pigment market is estimated at ~7 lakh tons p.a. with a market size of ~$ 970 Mn. Carbon black and Titanium dioxide (TiO2) account for 90% of the total pigment production.

Printing inks and coatings account for over 70% of consumption of pigments in India. Titanium dioxide is a major raw material used in the manufacture of paints. The paints industry is growing at 13.5% p.a. which has been a major demand driver for pigments.

There are also niche markets in India for special effect pigments such as metallic and pearlescent. These pigments are usually imported into the Indian market, with Sudarshan chemicals being the only domestic manufacturer. Though the volume for these pigments would be very small as compared to other pigment segments, they usually command a premium for the design appeal that they provide to the final product such as automotive coatings and packaging goods.

India has grown significantly as a producer and exporter of organic pigments, particularly phthalocyanine blue, green and some high performance pigments. India is amongst the largest sources of coloured organic pigments, competing with China for a dominant share of the export market.

Pigments by end use (% volume)

- Plastics 10%

- Textiles 10%

- Coatings 24%

- Inks 47%

- Others 9%

Demand-Supply Scenario

Major players in the pigments industry are Sudarshan Chemicals and Clariant India while in the dyestuff industry companies such as Atul, Clariant India, Kiri Dyes and IDI are large players in the organized sector. The organized sector, with a better product range, technology and marketing reach, has been able to increase market share. Further bans on certain dyestuffs due to regulatory norms from the European markets and stricter local pollution norms have forced many in the unorganized sector to exit resulting in increase in the share of the organized players. Total installed capacity for organic pigment is 80,000 tons p.a., which is way higher than the demand from the Indian market. Large proportion of the organic pigments produced is exported. Major producers of organic pigments include Meghmani Organics, Clariant India, Sudarshan Chemicals, Pidilite Industries and Heubach Colours.

Major players in the pigments industry are Sudarshan Chemicals and Clariant India while in the dyestuff industry companies such as Atul, Clariant India, Kiri Dyes and IDI are large players in the organized sector. The organized sector, with a better product range, technology and marketing reach, has been able to increase market share. Further bans on certain dyestuffs due to regulatory norms from the European markets and stricter local pollution norms have forced many in the unorganized sector to exit resulting in increase in the share of the organized players. Total installed capacity for organic pigment is 80,000 tons p.a., which is way higher than the demand from the Indian market. Large proportion of the organic pigments produced is exported. Major producers of organic pigments include Meghmani Organics, Clariant India, Sudarshan Chemicals, Pidilite Industries and Heubach Colours.

Growth Forecast & Drivers

There has been a strong growth in the dyestuff industry during the last decade. Export opportunities created by the closure of several units in countries like USA and Europe due to enforcement of strict pollution control norms, has resulted in a spurt of capacity building in India. However, the financial crisis in 2008 has resulted in a demand slump, worldwide over-capacity and has resulted in further margin pressures on the dyestuff industry.

As per industry reports, demand for dyes and organic pigments is expected to grow at 11% p.a. till 2020 to reach US$ 10 Bn. However, the industry can aim to grow faster at 15% to reach US$ 14.5 Bn. To achieve its aspirations, the industry needs to focus on the following:

Innovative products

- Increase emphasis on R&D

- Optimize the product portfolio

- Build better quality and high performance colorants

Green chemistry practices

- Improve environment friendliness of products and services.

- Ensure compliance to international regulations to continue access to the exports markets.

Due to greater use of polyester and cotton-based fabrics, there has been a shift towards reactive dyes, used in cotton-based fabrics, and disperse dyes, used in polyester. The demand for reactive and disperse dyes is expected to grow fastest due to this trend. The textile industry will remain the largest consumer of dyestuffs; however growth will be driven by markets such as printing inks, paints and plastics. These segments will also increase the consumption of high performance pigments helping improve profitability.

However, the gains will be restrained due to the commodity nature of the products and intense competition.

Industry Trends

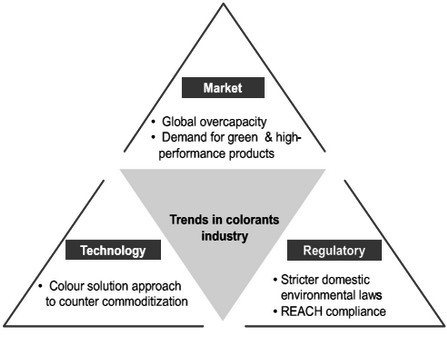

Market Trends

The global capacity of dyestuffs has exceeded demand resulting in an oversupply scenario. Due to the lack of export demand, the prices of the colorants had dropped by roughly 20%. It is expected that consumer preference for environmentally friendly products and high performance dyes and organic pigments will help improve overall value of the market.

Regulatory Trends

Fiscal policies and excise concessions led to a high level of fragmentation in the Indian dyestuffs market. However, a gradual reduction in the excise duties has resulted in a more balanced pricing differential between the organized and unorganized sectors. Regulations such as REACH (Registration, Evaluation, Authorization and Restriction of Chemical substances), which have been designed with the objective of protecting human health and environment from the hazards of chemicals, require that apparel and apparel chemical exporters to EU provide their buyers with information regarding the substance used in manu-facturing. Exporters who are not able to comply will lose their market share, resulting in closure of small units.

Technological Trends

Since majority of dyestuffs are commodities there is not much product differentiation & duplication of products is easy. To counter the same, global producers are investing in Research & Development to improve their specialty product portfolio. The industry could leverage technology to come up with newer products to meet the bottom of pyramid needs with innovative solutions. New technologies such as reduction with hydrogen & sulphonation with liquid sulphur trioxide could be adopted as they are clean technologies and give better yields, thereby reducing effluents. There is also a trend towards providing colour solutions rather than just a colourant. Collaborations with equipment manufacturers are being undertaken to provide integrated solutions to customers.

Future Outlook

The financial crisis in 2008 has resulted in a demand slump, worldwide over-capacity and further margin pressures on the dyestuff industry. The Indian dyestuff industry is facing challenges due to reduced export demand growth and decreasing profitability. Companies with greater focus on innovation and R&D will benefit in the long run. Adopting green chemistry practices and compliance to more stringent export market regulations would help ensure greater access to export markets. Such a holistic approach could ensure that the Indian dyes & pigments indu-stry is able to overcome the challenges and convert them to opportunities, resulting in profitable growth.

Specialty Chemicals

The specialty chemicals segment (including the knowledge chemicals) is, currently estimated at ~$ 27 Bn, The specialty chemicals segment caters to a large number of end use industries including construction, automotive, polymers, personal care products, water treatment, textile, paints and coatings, etc. The knowledge chemicals segment caters to the key end use industries of pharmaceuticals, agrochemicals and bio-technology.

The specialty & knowledge chemicals sector has been growing at rates higher than the overall chemical industry & is expected to continue to grow at 15%-17% p.a. to reach $ 80 -100 Bn by 2020. Major end use industries – textiles (esp. performance textiles), automotive, glass, constru-ction & paints- are all expected to register double digit growth rates in the next five years.