CM Narendra Modi inaugurates Asia Inter-dye exhibition 2011 in Ahmedabad

Asia Inter-dye 2011 – approved by China Council for the Promotion of International Trade (CCPIT) and India Trade Promotion Organization (ITPO),was held on December 8 -10 at Gujarat University Convention & Exhibition Centre, Ahmedabad. The exhibition was sponsored by China Dyestuff Industry Association (CDIA), China Dyeing and Printing Association (CDPA) and CCPIT Shanghai Sub-council, organized by Shanghai International Exhibition Service Co., Ltd. (SIESC) and co-organized by the Dyestuffs Manufacturers’ Association of India (DMAI). Asia Inter-dye 2011 is being branded as Asia’s biggest exhibition of colour chemicals manufacturing products.

The Exhibition was inaugurated by Gujarat Chief Minister Shri Narendra Modi. In his speech Shri Narendra Modi expressed his vision of becoming the leader in the global chemical manufacturing market by maintaining a balance between growth and environmental factors. He also stressed on research and development in environmental technology in order to become the global leader.

The Exhibition was inaugurated by Gujarat Chief Minister Shri Narendra Modi. In his speech Shri Narendra Modi expressed his vision of becoming the leader in the global chemical manufacturing market by maintaining a balance between growth and environmental factors. He also stressed on research and development in environmental technology in order to become the global leader.

Shri Modi called for the Centre, technical universities and chemical industry associations to make a joint plan to develop a common platform for R&D in the chemical sector. He pointed out that rich countries are not entering dyestuff industries, as they are scared of the pollution attached with it. Thus, it is both a challenge and an opportunity to initiate and achieve eco-friendly growth in this sector. He also exhorted manufacturers to develop a brand image for green chemicals.

President of China dyestuff manufacturing association said he was impressed by the ties between the companies of Gujarat and China. Chief Minister thanked the Chinese government for its positive approach in developing industrial relationship between Gujarat and China.

President of Indian dyestuff manufacturing association Ram Ajarekar and Secretary to government of India K.George Siviya praised the development of chemical industries in Gujarat.

A group of industrialists from Pakistan Chemicals and Dyes Merchants’ Association not only participated in the exhibition but also presented a replica of the Karachi Chamber of Commerce and Industry building as a memento to Shri Narendra Modi. This building is significant as none other than Mahatma Gandhi laid its foundation stone in July 1934. Shri Narendra Modi accepted the memento from the Pakistan delegation.

The Pakistan delegation also showed great interest in having a group photograph with Shri Modi, who gladly obliged. He also gave his personal autograph to the members of the delegation. They said that they wanted to learn a great deal from Gujarat and will take back a lot of things they learnt in Gujarat.

The President of the China Dyestuff Manufacturing Association stated that he was impressed with the ties between the companies of Gujarat and China. The President of the Mr. Ram Ajarekar and Secretary to the Government of India Mr. K George Siviya praised the development of Chemical industries in Gujarat. Minister of State for Industries Shri Saurabh Patel and other industry leaders were present for the occasion.

“Interdye Asia” is an international extension of “China Interdye”, which has been successfully held for 11 years and become the largest professional exhibition in the global dye-chemical industry. It is known as the world’s most prestigious brand-name exhibition in this industry. In order to accelerate the transformation of China dyestuff industry’s development mode and implement the strategy of “going out”, the organizers decided to hold the Asian tour. “Interdye Asia” obtained great attension and active participation from the international dye and pigment industries. A show space of more than 5000 sqm. was occupied by 120 famous companies from India, Singapore, U.K., China and Taiwan province, including Huntsman, Atul, JAY, Bodal, Colourtex, Colorant, Hindprakash, Lonsen, Runtu, Yabang, Jihua, JECO, Kedah, Shunlong, Jingjin, Qingshan, BOAO, Shenxin, Guangming, Dankong, Shanyu and ANOKY.

“Interdye Asia” is an international extension of “China Interdye”, which has been successfully held for 11 years and become the largest professional exhibition in the global dye-chemical industry. It is known as the world’s most prestigious brand-name exhibition in this industry. In order to accelerate the transformation of China dyestuff industry’s development mode and implement the strategy of “going out”, the organizers decided to hold the Asian tour. “Interdye Asia” obtained great attension and active participation from the international dye and pigment industries. A show space of more than 5000 sqm. was occupied by 120 famous companies from India, Singapore, U.K., China and Taiwan province, including Huntsman, Atul, JAY, Bodal, Colourtex, Colorant, Hindprakash, Lonsen, Runtu, Yabang, Jihua, JECO, Kedah, Shunlong, Jingjin, Qingshan, BOAO, Shenxin, Guangming, Dankong, Shanyu and ANOKY.

Exhibits covered all kinds of ecological and environmental-friendly dyes, organic pigments, printing and dyeing auxiliaries, relevant equipment and other products.

Chemical Industry plays a vital part in the India economy. According to the figures from Ministry of Chemicals and Fertilizers, the whole revenue of the chemical industry has been 35 billion dollars, accounting for 3% of India GDP, representing 13-14% of all exports and 8-9 % of all imports in India. The investment for the industry amounts to 60 billion dollars, number of the persons employed by the industry reaches 1 million. Based on the outputs of India, India has been No.12 country in the world and No.3 in Asia in the chemical industry.

The textile dyeing and printing industry in India has experiences a rapid growth and the development is expected to accelerate to double-digit growth in the next years.

India occupied a pivotal position in the global textile dyeing and printing industry, second only to China. She also ranks No.7 in the world in the trade of textile dyeing and printing and No. 5 in the trade of ready-made clothes.

Indian textile dyeing and printing industry is the No.1 industry in terms of revenue and No. 2 industry in terms of number of employees in India.

In recent years, China-India trade has grown continuously and promises bright prospects. The China-India imports and exports of dyestuff in 2010 reached 25.7 kilo tons, up 7.2% yoy. The trade value of dyestuff in 2010 amounted to USD143 million, up 47.8% yoy. The China-India imports and exports of pigments in 2010 reached 5327 tons, up 15.9% yoy.

The trade value of pigments in 2010 amounts to USD41.32 million, up 50.4% yoy. The China-India imports and exports of auxiliaries in 2010 reached 15 kilo tons, up 30% yoy. India is one of China’s chief export countries of dyestuff, ranking the second in more than 120 export destinations.

Interdye Asia 2011 also attracted numerous dyeing and printing enterprises and dyeing distributors from India and neighboring countries to purchase or negotiate in the exhibition.

Among those sourcing groups was Pakistan Dye Chamber of Commerce that sponsored a purchasing delegation of about 70 people.

China’s Dyestuff Industry

During China’s 11th Five-year Plan, China’s gross production of dyestuffs ranked first in the world, accounting for 60% of all dyestuffs produced globally. According to statistics, China produced a total of 756,000 tons of dyestuffs in 2010, an increase of 5% year-on-year; sales revenues were RMB 39.6 billion, an increase of 10.9% year-on-year, and production more or less returned to its pre-financial crisis levels. Exports hit 273,000 tons, an increase of 14.7% year-on-year, and foreign exchange earned through export was USD$1.175 billion, an increase of 27.7% year-on-year. Exports of organic pigments were 154,000 tons, an increase of 30.8% year-on-year, and foreign exchange earned through export was USD$1.023 billion, an increase of 42.3% year-on-year.

However, owing to the pressing importance of developing a low-carbon and circular economy and promoting energy efficiency and emissions reduction, the development of China’s dyestuffs industry during China’s 12th Five-year Plan must start with a transition from the exploitation of resources to the improvement of the industry structure, from an emphasis on quantitative growth to an emphasis on qualitative growth, and from a pursuit of purely economic growth to a pursuit of growth in all senses of the word. The upgrading of the industry, promotion of energy efficiency, reduction of pollutant emissions, growth of clean production, and increase in regulation will all be important issues relevant to the development of the industry.

Clean production key for dyestuffs industry

The sustained development and promotion of clean production technology will create favorable conditions for the sustainable development of the dyestuffs industry as it focuses on reducing the waste of water, gas, and industrial residue. Catalytic technology, sulfonation technology, solvolysis reaction technology and other clean production technologies and recycling technolo-gies will enable an annual reduction of 12 million tons of waste water and 300,000 tons of COD (chemical oxygen demand), lowering production and administration costs and saving a great amount of water resources.

By the end of China’s 12th Five-year Plan, waste water and COD generated by China’s dyestuffs industry will have been cut by 10% from the rates of the 11th Five-year Plan period, and will account for 15% and 18% of the industry’s total production respectively. It is for this purpose that China Interdye 2011 established a special exhibition zone focusing on environmental protection and energy saving technologies. DyStar, Braun, South Korea’s RIFA, and China’s Longsheng and Runtu, as well as a great number of other industry-leading companies, exhibited the newest technologies for whose core and critical technologies they independently own all patents, copyrights and trademarks, and these companies strived to gain increased market share through their superior product quality.

The development of organic pigments and their brand

The rapid growth of the Chinese and international printing, paint, plastics, fibers, and other related industries is spurring the development of the Chinese organic pigment industry. During the time period of China’s 11th Five-year Plan, China’s organic pigment industry maintained an annual production rate of around 180,000 to 220,000 tons, and in 2010, annual production exceeded 220,000 tons, accounting for around 40% of all production of organic pigments in the world. However, high-performance organic pigments made up a relatively small portion of this amount, which was the main reason for the fierce price competition and resulting drop in the rate of profits, and the majority of companies’ exports are still realized through processing trade and original equipment manufacturers (OEMs).

The rapid growth of the Chinese and international printing, paint, plastics, fibers, and other related industries is spurring the development of the Chinese organic pigment industry. During the time period of China’s 11th Five-year Plan, China’s organic pigment industry maintained an annual production rate of around 180,000 to 220,000 tons, and in 2010, annual production exceeded 220,000 tons, accounting for around 40% of all production of organic pigments in the world. However, high-performance organic pigments made up a relatively small portion of this amount, which was the main reason for the fierce price competition and resulting drop in the rate of profits, and the majority of companies’ exports are still realized through processing trade and original equipment manufacturers (OEMs).

This year, well-known exhibiting enterprises that produce high-performance organic pigments, including Shanghai’s Jeco, Hebei’s Meilida, and Shanghai Silian, exhibited their achievements in brand development. Additionally, a number of rapidly developing small- and medium-sized enterprises (SMEs) participated in the exhibition, demonstrating from yet another angle the crucial transition China is undergoing, as it transforms itself from a big producer of organic pigments into a strong producer of organic pigments.

Recently, China Dyestuff Industry Association issued a “12th Five-Year” Plan aimed at building dye industrial power by achieving industrial output growth rate of 8-10% and focussing on promoting the environmental friendly, economical and high performance organic pigments and additives. Currently, there is overcapacity of low-end products, disorderly competition of similar products and a serious lack of products conforming to toxicological and eco toxicological standards.

The focus of the 12th Five Year Plan, therefore, would be on high performance, novel reactive dyes, disperse dyes, high-grade organic pigments, digital ink-jet printing dyes, textile auxiliaries, high performance masterbatches. The Plan will focus on the development of high-tech: catalytic technology, three sulfur trioxide sulfonation technology, continuous nitration technology, adiabatic nitration technology, directional chlorination technology, combination technology of synergism, solvent reaction technolo-gy, recycling technology, instead of phosgene and highly toxic raw materials application technology to cater to the value-added market and gradually improve China’s dyestuff market value globally.

Indian dyestuff industry

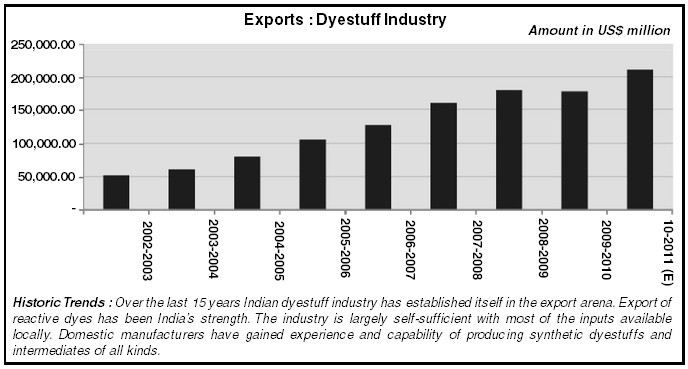

The Indian dyestuff industry has been facing difficult times. Low profitability and demand growth combined with increasing importance for environmental protection have resulted in the exit of many small producers. However these factors have seen the consolidation of major players in the industry. Currently there is an over capacity situation in the domestic market that has forced the industry to look at exports for growth. With the closure of many manufacturing bases in the US and Europe, MNCs are shifting to Asian countries like India and China. The share of the MNCs in the domestic production of these two countries has been going up steadily over the last few years.

Industry Structure

The Indian dyestuff industry is only about 40 years old though a few MNCs set up dyestuff units in the pre independence era. Like the rest of the chemical industry, the dyestuff industry is also highly fragmented. The industry is characterised by the co-existence of a small number of players in the organised sector (around 50 units) and a large number of small manufacturers (around 1,000 units) in the unorganised sector. The distribution of these units is skewed towards with western region (Maharashtra and Gujarat) accounting for 90%. In fact, nearly 80% of the total capacity is in the state of Gujarat, where there are nearly 750 units.

There has been a strong growth in the dyestuff industry during the last decade. This has been made possible because of the Government’s concessions (excise and tax concessions) to small-scale units and export opportunities created by the closure of several units in countries like the USA and Europe (because of the enforcement of strict pollution control norms). The duty concessions offered to small-scale manufacturers had resulted in the large ones becoming uncompetitive to some extent. Price competition was intense in the lower segments of the market. Liberalisation of the economy and large-scale reduction of duties resulted in the reduction of margins for smaller manufacturers.

Closure of several small-scale units in Gujarat on environmental reasons also helped the organised sector players.

Over six hundred types of dyes and organic pigments are now being manufactured in the country (both by the organised and the unorganised sector). But the per-capita consumption of dyestuffs is lower than the world average. Dyes are soluble and essentially used in textile products. Pigments, on the otherhand, are insoluble and are important inputs to products such as paints.

During the past two years, the dyestuff industry was overtaken by a series of fast changing events in the international arena. Indian companies failed to keep pace with the changing trends. The biggest market for dyestuffs has been the textile industry. The dominance of polyester and cotton in the global markets has decisively shaped the demand for certain types of dyestuffs. On the other hand, the demand for polyamides, acrylics, cellulose and wool was more or less stagnant. Differences in the regional growth rates of textile products too affect demand. The Asian region saw the biggest growth in textile production, followed by North America, Latin America and Western Europe.

This suggests the shift in the global textile industry towards Asia. As a result, Asia leads in dyestuff production both in terms of volumes and value, with a 42% share of the global production; the US is next with 24% and Europe has around 22%. Due to a greater use of polyester and cotton-based fabrics, there has been a shift towards reactive dyes, used in cotton-based fabrics, and disperse dyes, used in polyester. These two dyes have been dominant in all the three regional global market, especially Asia. Adding to the shift in textile usage pattern and regional developments, is the extent of over capacity in the global dyestuff industry. Capacity is estimated to be around 1.2 mn tonnes, with consumption at 0.8 mn tonnes, leaving a clear gap of 0.4 mn tonnes.

Nearly 80% of the dyestuffs is commodities. This means there is not much product differentiation between the goods manufactured by most producers. Since not much technology is involved, duplication of products is also easy compared to specialties. However, in the recent past, there have been attempts by global manufacturers to move to the specialty end of the product profile, with some success. Vat dyes have always functioned as specialty products, with technology playing an important role. Now, companies are concentrating on the higher end of the reactive dyes segment. The trend is now shifting from supplying mere products to colour package solutions. The emphasis is more on innovation, production range, quality and environmental friendly products. Producers are collaborating with equipment manufacturers to provide integrated solutions rather than products.

Technology

The technology for dyestuff manufacturing varies widely from relatively simple (direct azo) to sophisticated (disperse and vat) dyes. Though technology is locally available, most of it is outdated. The problem is further compounded by the fact that the nature of the process changes from batch to batch and, therefore, controlling the process parameters becomes difficult. The Indian industry has made significant progress in terms of technology and production.

The dyestuff industry is one of the heavily polluting industries and this has resulted in the closure of units internationally and shifting of units to the emerging economies. Most of the international manufacturers have transferred the technology to developing nations like China, India, Indonesia, Korea, Taiwan and Thailand.

This shift of manufacturing capacities is because the industry is perceived as a high-cost and low return one. The batch processing also makes it a labour- intensive industry. Thus, the competitiveness of developing economies increases. However, the judiciary has come down with a heavy hand on several manufacturing units, all over the country.

Disperse and Reactive dyes constitute the largest product segments in the country constituting nearly 45% of dyestuff consumption. In future both this segments will dominate the dyestuff market with Disperse dyes likely to have the largest share followed by reactive dyes. These two segments will have the largest share on account of dominance of textile and synthetic fibers in dyestuff consumption. Vat segment is also expected to record positive growth in future.