Cottonseed and cotton linter market performance is much divided this year as the former has been popular with prices rising constantly, while the latter is sable to weaker.

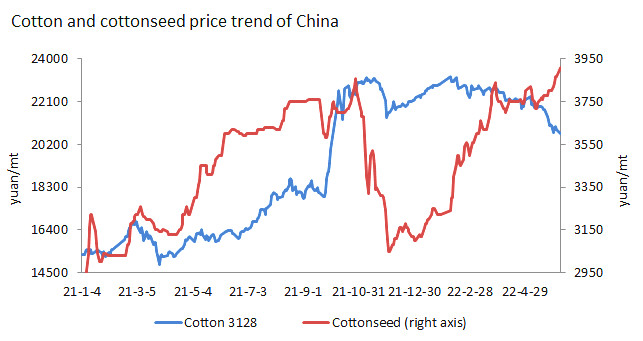

Textiles keep weak appearance this year. The demand for cotton has been dreary as almost half of the cotton in Xinjiang has not been sold. Cotton enterprises are under big repayment pressure during May-Jul and global cotton planting area of 2022/23 crop year increases, so the output is expected to be growing. Coupled with negative influence from ban on Xinjiang cotton, cotton price of China has been shedding recently.

However, the spot goods of cottonseed are reducing during the transition period of supply. Coupled with fewer stocks and high price of crude oil this year, cottonseed oil price has become stronger and keeps hitting new highs, so cottonseed price bolstered by several bullish factors keeps rising.

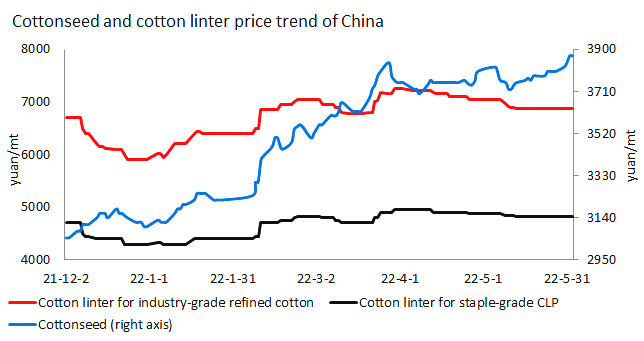

The storage cost of cottonseed is increasing in the later period of 2021/22 crop year. Moreover, there is driving force from tightening supply and hiking cottonseed oil, so the price of cottonseed has been going up. In Shandong and Hebei, cottonseed oil has been soaring above 12,000yuan/mt and high-quality cottonseed is around 3,900yuan/mt. Xinjiang-origin cotton has risen to around 4,600yuan/mt, respectively up 42%, 26% and 31% from the beginning of this year.

Cotton linter market has gradually stabilized since mid-May with increasing support from the cost of cottonseed, but due to weaker demand from downstream segment like refined cotton, there was bigger divergences between the price of cottonseed and cotton linter as the former keeps hiking, while the latter stabilizes amid weakness.