Despite the difficult domestic and international economic environment, Vietnam – U.S. bilateral trade in 2011 was US$21.8 billion, up 17.5% over the previous year, with Vietnam’s exports to the U.S. $17.5 billion (up 18%), and imports from the U.S. $4.3 billion (up 17%), demonstrating once again that manufacturing foreign direct investment (FDI) and trade are strong and stable factors that support Vietnam’s economic and social development. In comparison, total bilateral trade in 2012 may reach about US$24.6 billion (up 12.8%), with Vietnam’s exports to the U.S. about $20.0 billion (up 14%), and imports from the U.S. about $4.6 billion (up 7%).

Growth of Vietnam’s apparel exports to the U.S. is likely to continue to slow because of increasing labour costs, increased competition from countries such as India, Indonesia, Bangladesh, and Mexico, not to mention Cambodia and Myanmar, and reduced demand in the United States. The hope for Vietnam is that exports of “modern manufacturing” and services will take up the slack, both in export revenue and employment.

However, lack of trained workers and increasing wage costs without productivity gains in the factories and efficiencies in the economy (transportation infrastructure, customs, business services) that reduce costs may slow the growth of Vietnam’s exports to the U.S. According to the Asian Development Bank, less than 30% of young workers, who comprise half the workforce, have completed upper secondary education.

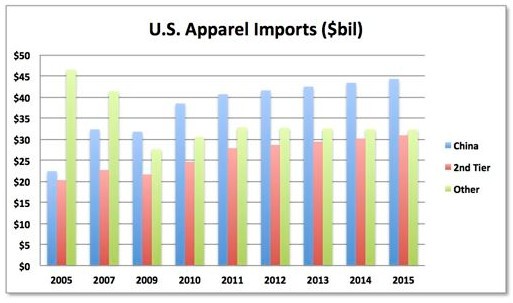

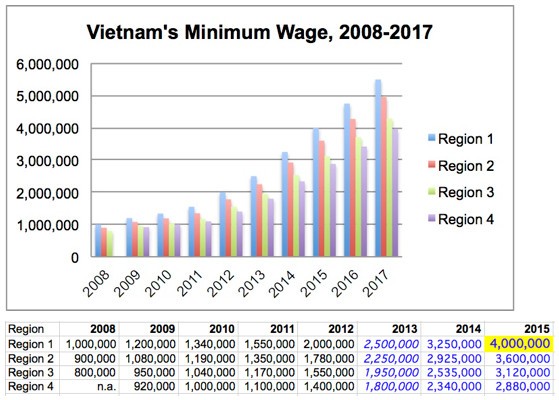

As for increasing labour costs, the below chart and table show actual minimum wages in vnd/month 2008-2012, proposed minimum wages in 2013, and projected minimum wages in 2014-2017 based on the Party Central Committee Decision 23-KL/TW, May 29, 2012 to “Adjust the minimum wage more rapidly in the private sector so that by 2015 the minimum will reach the level of the Basic Needs Wage.” Vietnam rapidly achieved the status of 2nd-ranked supplier to the U.S. textiles and apparel import market after entry into effect of the Vietnam-U.S. Bilateral Trade Agreement in December 2001 and Vietnam’s entry into WTO in January 2007, more than doubling its exports from about $3 billion in 2005 to over $7 billion in 2011, taking market share mostly from Mexico, it seems. However, Vietnam’s rapid growth of textile and apparel exports to the U.S. market has slowed since 2010 as other “2nd Tier Countries,” such as Indonesia, Indonesia, and Bangladesh, steadily increased their exports, while Mexico seems to have halted and reversed, since 2010, the sharp fall in its exports to the U.S. between 2005 and 2009. However, according to a number of industry experts, India’s infrastructure for garment manufacturing is still not adequate to match its raw material sources, which may be the core of their exports to the U.S. (cotton fiber, cotton yarn, fabric) and India still has much more to do in order to utilize all of their local raw materials, which may be difficult for them to achieve in the next 5 years. Mexico has NAFTA preferential access to the U.S. market.

Vietnam rapidly achieved the status of 2nd-ranked supplier to the U.S. textiles and apparel import market after entry into effect of the Vietnam-U.S. Bilateral Trade Agreement in December 2001 and Vietnam’s entry into WTO in January 2007, more than doubling its exports from about $3 billion in 2005 to over $7 billion in 2011, taking market share mostly from Mexico, it seems. However, Vietnam’s rapid growth of textile and apparel exports to the U.S. market has slowed since 2010 as other “2nd Tier Countries,” such as Indonesia, Indonesia, and Bangladesh, steadily increased their exports, while Mexico seems to have halted and reversed, since 2010, the sharp fall in its exports to the U.S. between 2005 and 2009. However, according to a number of industry experts, India’s infrastructure for garment manufacturing is still not adequate to match its raw material sources, which may be the core of their exports to the U.S. (cotton fiber, cotton yarn, fabric) and India still has much more to do in order to utilize all of their local raw materials, which may be difficult for them to achieve in the next 5 years. Mexico has NAFTA preferential access to the U.S. market.

The below chart shows that a “new normal” may have been achieved after the removal of U.S. apparel import quotas for WTO members in 2005, and for Vietnam in 2007, when Vietnam became a WTO member. U.S. apparel imports from “Other Countries” dropped by more than one-third, from $46.5 billion to $30.5 billion between 2005 and 2010; U.S. apparel imports from China nearly doubled from $22.4 billion in 2005 to $40.7 billion in 2011; and U.S. apparel imports from “2nd Tier Countries” increased by 37% from $20.3 billion to $27.9 billion in 2011. Since 2010~2011, it seems that a new equilibrium may have been reached, with the outlook for China’s apparel exports growth to the U.S. to decrease slowly over time, as more companies join the “leaving China” movement, while exports from the “2nd Tier Countries” and “Other Countries” increase slowly. Indonesia, where FDI doubled to $20 billion in 2011, Bangladesh, which recently hosted an AmCham Hong Kong apparel sourcing delegation accounting for $5.8 billion/yr, and Myanmar are seen as the most promising FDI destinations for those “leaving China.” Based on recent trends, U.S. apparel imports from Vietnam would increase, but the proposed doubling of the minimum wage by 2015 could reverse that trend.

Preferential Market Access : Vietnam’s WTO accession in 2007 and earlier preferential market access to Japan, the EU since 1992, and the United States since 2001 have played a key role in promoting the sector. Currently, Vietnam faces preferential market access to Japan, where it has enjoyed duty-free market access since 2009 in the context of the Vietnam-Japan EPA, as well as to the EU, where Vietnam enjoys GSP status. However, in the U.S. market (Vietnam’s most important export market), Vietnam’s apparel exports face MFN tariffs. Vietnam’s export development has also been influenced by the growth of regional trade arrangements. Vietnam’s most important regional trade agreement is ASEAN, which it joined in 1995 (the same year that WTO accession talks formally began). Exports to ASEAN have been duty free since 2009. One of the principal objectives of tariff elimination within ASEAN is to stimulate the development of a regionally integrated industry, with individual countries differentiating in terms of product mix, design, and quality. As a member of ASEAN, Vietnam is part of the ASEAN-China Free Trade Agreement (ACFTA). ACFTA was signed in 2002 and is being implemented in stages. ASEAN also has a trade agreement with Korea.

In summary, the 2013 Minimum Wage levels for the private sector, effective Jan 1, 2013, are:

- 2.350.000 vnd/month for enterprises in Region I

- 2.100.000 vnd/month for enterprises in Region II

- 1.800.000 vnd/month for enterprises in Region III

- 1.650.000 vnd/month for enterprises in Region IV

For reference, the State Sector Minimum Wage is 1.150.000 vnd/month, effective Jul 1, 2013.