The German Textile Cleaning Association has published the textile service cost index for the second half of 2020. The list shows: The corona pandemic does not reduce costs in textile service, especially in Germany. A development that hits an already ailing industry. The association therefore warns of an unhealthy price war within the industry.

Costs In The Textile Service Industry

Berlin – The latest economic figures show that the corona pandemic is not easing the costs of the textile service. Domestic costs in particular continue to rise. The development hits an industry that, as a supplier to the hotel, catering and event industry, which has been particularly hard hit by the lockdown, is already badly hit. Against this background, the German Textile Cleaning Association (DTV) warns of an unhealthy price war within the industry.

After more than a year of economic restrictions, many textile service companies have their backs to the wall. Sales in the industry had already slumped drastically in 2020 and the sales decline for the laundries operating in the hotel and catering sector is currently over 90 percent compared to the pre-Corona period.

Anyone who had hoped that the pandemic would at least reduce production costs will have to realize that this does not apply to the textile service. While producer prices in the entire economy fell slightly on average in 2020, the textile service cannot benefit from this trend.

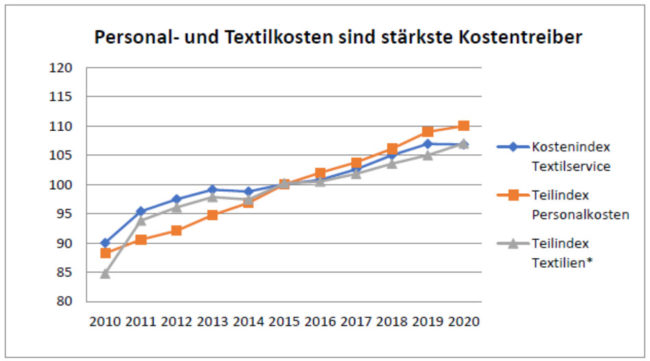

Personnel and textile costs are the main cost drivers

The biggest cost drivers for textile service in 2020 were personnel and textile costs. And in 2021, the increase in the statutory minimum wage by 2.6 percent will place an additional burden on companies. There are also signs of a continuation of the trend in textile costs. The main reason is the rising prices for cotton and polyester yarns. Strong demand in the Far East is also pushing the rise in costs.

The costs for energy and consumables will also rise noticeably. Starting in 2021, the price of CO2 will make petrol, diesel, heating oil and natural gas more expensive and the cost index for textile services will continue to rise.

Unhealthy competition threatens

The industry association DTV warns against the background of the corona pandemic of an unhealthy price war in the textile service industry. If the forecasts are confirmed that there will be numerous bankruptcies in the catering and hotel industries, then this could lead to a dangerous battle for the remaining business customers.

The price war driven by the pandemic would ultimately not bring any advantages to the textile service customers either. Even before the coronavirus pandemic, the number of textile service companies in Germany had steadily decreased. In addition to the closure of many small businesses, there has already been market concentration through mergers and takeovers. In the end, customers always pay the price for monopoly.

Backgrounds

Every six months the DTV publishes a cost index for the textile service, which shows the development of the total costs and their individual components for the textile service companies. The aim is to ensure the greatest possible transparency and traceability of costs for both companies and customers. Individual cost groups from the data from the Federal Statistical Office serve as the basis. As a result, the cost index provides a solid and neutral data basis that represents the development of the relevant cost items in the textile service.

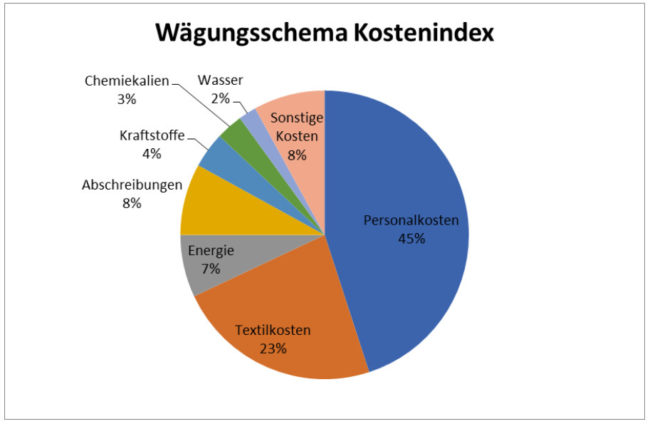

Weighting scheme cost index 2020 2nd half

Starting from the base year 2010, the changes in costs are shown. For this purpose, the cost structure of a typical mixed operation was worked out, which represents the cost structure of the entire industry. All cost groups from the textile service are included in the index. The most important of these are those for personnel and textile procurement as well as those for energy and depreciation.

Methodological note: The Federal Statistical Office reduced the shopping basket for domestically produced workwear with the reference year 2015. The price indices for flat linen and for imported goods remained unaffected. Nevertheless, the cost index for textiles before 2015 is therefore only comparable to a limited extent with the textile cost index from 2015 onwards.